Page 2 - Fiduciary Oversight | First Actuarial

P. 2

Are your investments roadworthy?

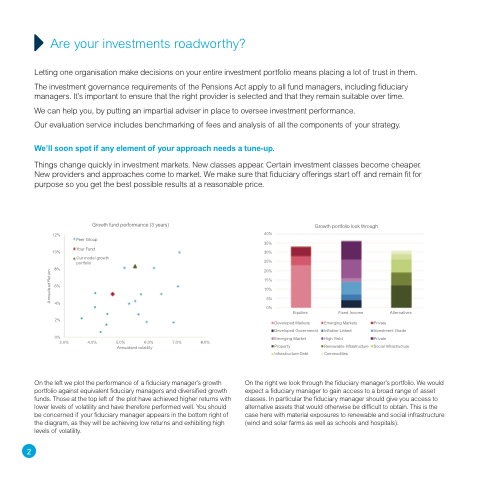

Letting one organisation make decisions on on on on your entire investment portfolio means placing a a a a a a lot of trust in in in in them The investment governance requirements of the Pensions Act apply to all fund managers including fiduciary managers It’s important to ensure that that the the right provider is selected and that that they remain suitable over time We can help you by putting an an an impartial adviser in in in place to oversee investment performance Our evaluation service includes benchmarking of of of fees and analysis of of of all the components of of of your strategy We’ll soon spot if any element of your approach needs a a a a tune-up Things change quickly in in in in in investment investment markets New classes classes appear Certain investment investment classes classes become cheaper New providers and and approaches come to market We make sure that fiduciary offerings start off off and and remain fit for purpose so so you get the best possible results at a a a a reasonable price 12% 10% 8% 6% 4% 2% 0% 40% 35% 30% 25% 20% 15% 10% 5% 0% Growth fund performance (3 years)

Peer Group

Your Fund

Our model growth por tfolio Growth portfolio look through

3 0% 0% 0% 4 0% 0% 0% 5 0% 0% 0% Annualised volatility

Equities

Developed Markets Developed Government Emerging Market Property

Infrastructure Debt

Fixed Income

Emerging Markets Inflation-Linked

High Yield

Renewable Infrastructure Commodities

Alternatives

Private

Investment Grade Private

Social Infrastructure On the the left we plot the the performance of a a a a a fiduciary manager’s growth portfolio against equivalent fiduciary managers and diversified growth funds Those at the the top left of the the plot have achieved higher returns with lower levels of volatility

and have therefore performed well You should be concerned if your fiduciary manager appears in the bottom right of the the diagram as they will be achieving low returns and exhibiting high levels of volatility

2 On the the right we look through

the the fiduciary manager’s portfolio We would expect a a a a a a a a a a fiduciary manager to to gain access to to a a a a a a a a a a broad range of asset classes In particular the fiduciary manager should give you access to alternative assets that would otherwise be difficult to obtain This is is is the the case here with material exposures to renewable and social infrastructure (wind and and solar farms as as well as as schools and and hospitals) 6 0% 0% 0% 7 0% 0% 0% 8 0% 0% 0% Annualised Return