Page 2 - How to win at buy out | First Actuarial

P. 2

How to win at buy-out - the rules

When to buy-out

The buy-out shortfall may seem high but with careful planning this can turn around quickly. Start now and plan to succeed.

How to prepare your scheme

How to reduce the cost to you

Action plan Data cleanse

Annual check on data

Review of documentation

Regular monitoring Smart Investment

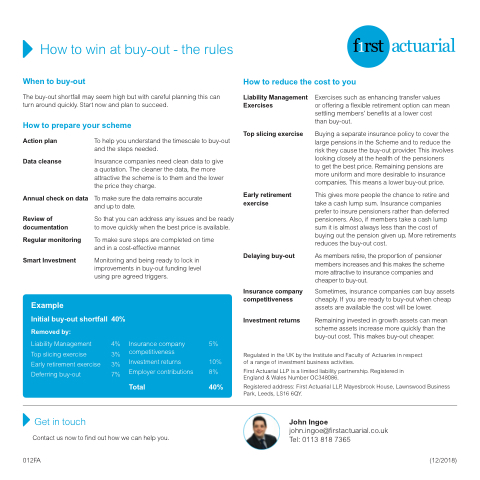

Example

Initial buy-out shortfall 40%

Removed by:

Liability Management

Top slicing exercise

Early retirement exercise 3% Deferring buy-out 7%

Get in touch

Liability Management Exercises

Top slicing exercise

Early retirement exercise

Delaying buy-out

Insurance company competitiveness

Investment returns

Exercises such as enhancing transfer values

or offering a flexible retirement option can mean settling members’ benefits at a lower cost

than buy-out.

Buying a separate insurance policy to cover the large pensions in the Scheme and to reduce the risk they cause the buy-out provider. This involves looking closely at the health of the pensioners

to get the best price. Remaining pensions are more uniform and more desirable to insurance companies. This means a lower buy-out price.

This gives more people the chance to retire and take a cash lump sum. Insurance companies prefer to insure pensioners rather than deferred pensioners. Also, if members take a cash lump sum it is almost always less than the cost of buying out the pension given up. More retirements reduces the buy-out cost.

As members retire, the proportion of pensioner members increases and this makes the scheme more attractive to insurance companies and cheaper to buy-out.

Sometimes, insurance companies can buy assets cheaply. If you are ready to buy-out when cheap assets are available the cost will be lower.

Remaining invested in growth assets can mean scheme assets increase more quickly than the buy-out cost. This makes buy-out cheaper.

To help you understand the timescale to buy-out and the steps needed.

Insurance companies need clean data to give a quotation. The cleaner the data, the more attractive the scheme is to them and the lower the price they charge.

To make sure the data remains accurate and up to date.

So that you can address any issues and be ready to move quickly when the best price is available.

To make sure steps are completed on time and in a cost-effective manner.

Monitoring and being ready to lock in improvements in buy-out funding level using pre agreed triggers.

4% 3%

Insurance company 5% competitiveness

Regulated in the UK by the Institute and Faculty of Actuaries in respect of a range of investment business activities.

First Actuarial LLP is a limited liability partnership. Registered in England & Wales Number OC348086.

Registered address: First Actuarial LLP, Mayesbrook House, Lawnswood Business Park, Leeds, LS16 6QY.

Investment returns

Employer contributions 8%

Total 40%

10%

Contact us now to find out how we can help you. 012FA

John Ingoe

john.ingoe@firstactuarial.co.uk Tel: 0113 818 7365

(12/2018)

| 1 2 |