December 5, 2019

What is the impact of pensions taxation and the Annual Allowance on the NHS and its employees? First Actuarial’s Dale Walmsley reports on a survey carried out this year with NHS Employers.

Concerned about the impact of pensions taxation – and the Annual Allowance in particular – NHS Employers asked First Actuarial to carry out some independent research, to see how widespread the problem was.

First Actuarial and NHS Employers proceeded to work together on an online survey. We asked 30 organisations in the NHS – mainly hospitals and trusts – to issue the survey to all employees earning over £60,000 in May and June 2019. We received 2,521 completed responses.

The survey confirms that many NHS employees, consultants in particular, are affected by this. While only around one-third of respondents have received Annual Allowance tax charges in the past, over half believe they will receive them in the future.

Read our infographic for key findings of this important survey:

What do NHS employees say about their pensions?

This infographic summarises key findings from a report prepared independently by First Actuarial for NHS Employers. The report, published in June 2019, investigated the impact of the pensions tax across 30 NHS organisations.

2 in 5respondents describe their pensions knowledge as low

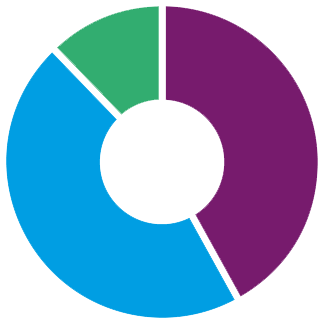

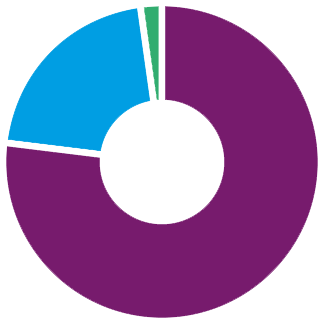

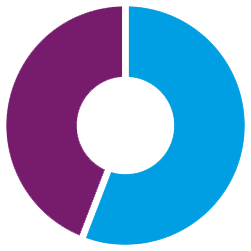

Respondents’ knowledge of pensions

Almost 1 in 4respondents have not accessed their Total Reward Statement in the last 2 years to look at their pension benefits.

Have respondents accessed their Total Reward Statement over the past 2 years?

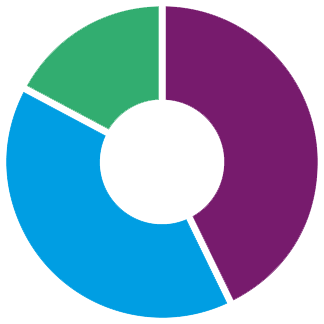

How well do people understand the Annual Allowance?

Almost half of respondents have a low understanding of the Annual Allowance.

I am not alone in this and I see a huge number of my colleagues bewildered, disillusioned and forced to take steps which will weigh heavy on their conscience as the only way out of this punitive taxation is to reduce our work leading to a disastrous compromise in patient care.

NHS employee

How many employees have exceeded their Annual Allowance?

Between 2013/14 and 2017/18, 84,048 NHS Pension Scheme members exceeded their Annual Allowance, according to a Freedom of Information request from Quilter.

In our survey…

56%

of respondents think they’ll be affected by an Annual Allowance breach in the future.

2 in 3survey respondents intend to take or have taken financial advice on their pensions tax position.

Pension tax issues can affect any grade of staff not just high earners especially as the new pay scales now have bigger incremental increases. Staff on any band could be affected by the Annual Allowance.

NHS employer

Research report

The full research report on the impact of pensions tax in the NHS is freely available on the NHS Employers website

The Annual Allowance is unquestionably the biggest problem in the NHS pensions tax situation. Although only a small proportion of NHS staff are affected, with almost 1.6 million active members in the NHS Pension Scheme, this can add up to a large number of people.

So how can NHS trusts and other employers move forward on this? Well, they can help their employees understand their total reward package, including their pensions. One in four respondents have not looked at their Total Rewards Statements in the past two years, so they’re not monitoring their pension benefits on a regular basis.

NHS employers pay a total of 20.68% of pensionable pay for all scheme members. That is surely worth shouting about.