Page 4 - Fiduciary Oversight | First Actuarial

P. 4

Fiduciary product testing and analysis

Our evaluation work is

is

is

supported by detailed portfolio analysis

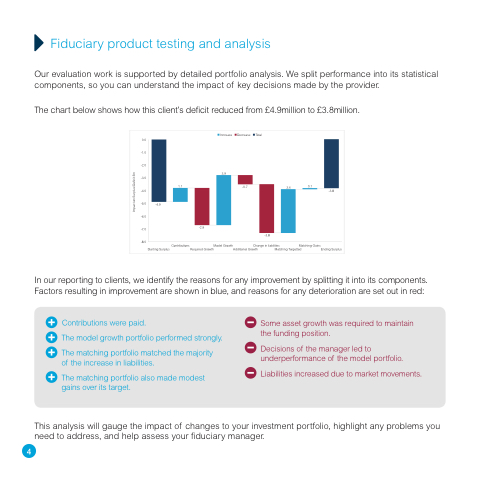

We split performance into its statistical components so you can understand the the impact of key decisions made by the the provider The chart below shows how how this client’s deficit reduced from £4 9million to £3 8million Increase

3 9 Decrease

-0 7

Total

0 0 0 0 -1 0 -2 0 -3 0 -4 0 -5 0 -4 9 -6 0 -7 0 -8 0 1 1 1 1 Contributions

3 4 0 1 Matching Gains

-3 8 Ending Surplus

Starting Surplus

Model Growth Required Growth Change in liabilities

Additional Growth Matching Targetted

-2 9 -3 8 In our reporting to to clients we identify the reasons for any improvement by splitting it it it into its components Factors resulting in in in in improvement are are shown in in in in blue and reasons for any deterioration are are set out in in in in red:

Contributions

were paid The model growth portfolio performed strongly The matching portfolio matched the majority of the increase in in liabilities

The matching portfolio also made modest gains over its target Some asset growth was required to maintain the funding position Decisions of the manager led to underperformance of the model portfolio Liabilities increased due to market movements This analysis

will gauge the impact of changes to your investment portfolio highlight any problems you you need to address and help assess your fiduciary manager 45

Impact on Surplus/Deficit £m