We can offer you an experienced and knowledgeable consultant, secure access to fund information on our online Hub, and specialist services at competitive rates.

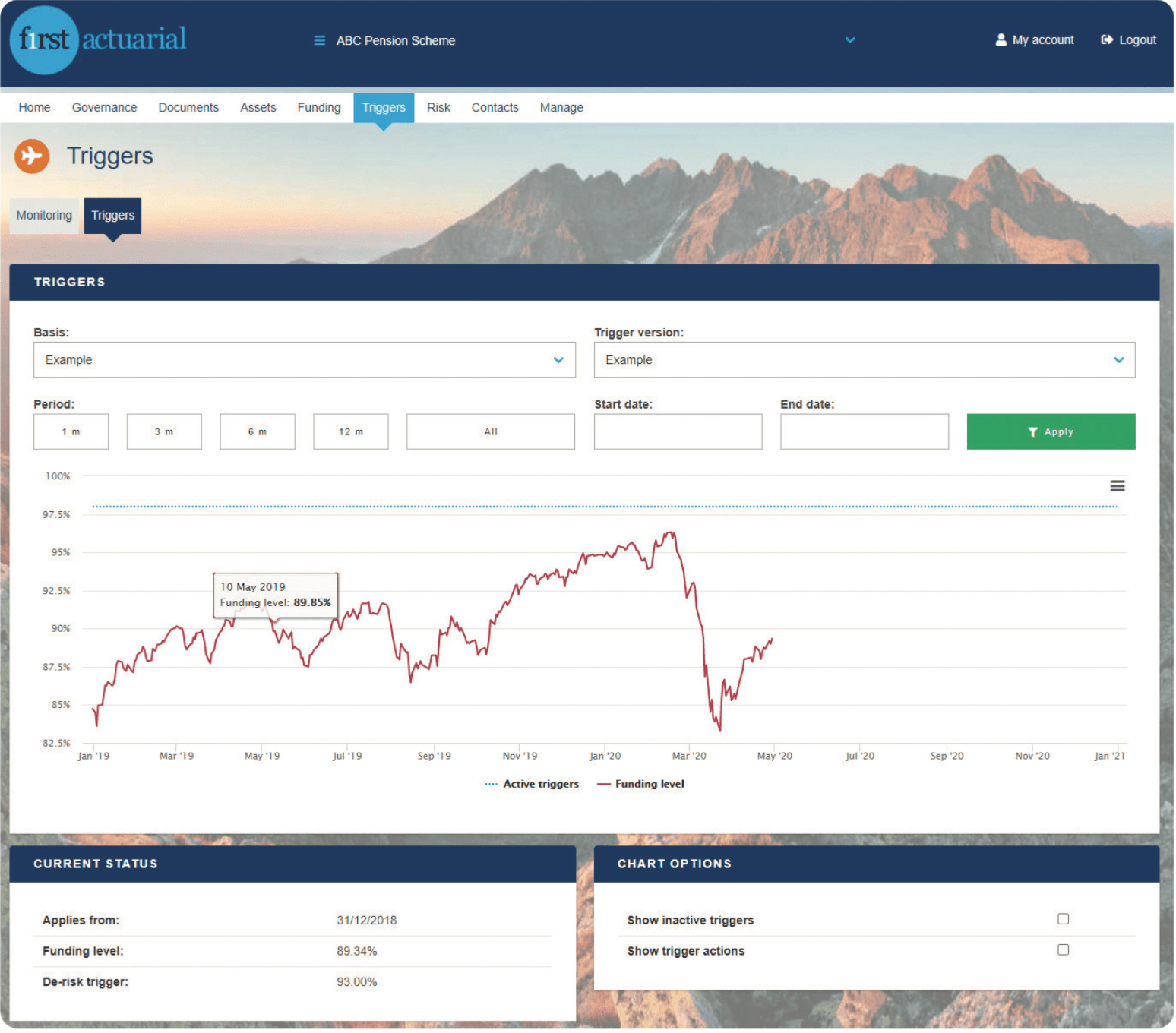

With First Actuarial’s expert investment team behind you, your scheme is more likely to achieve its target date and reduce uncertainties in long-term planning. We give trustees peace of mind that they won’t miss the chance to lock in funding improvements.