Our investment monitoring service covers the performance objectives, volatility targets and fee details of funds held by your pension scheme.

We monitor investments and liabilities, and choose the right time to switch investments to reduce risk and maximise gains. We provide basic information on valuations, performance and funds, along with:

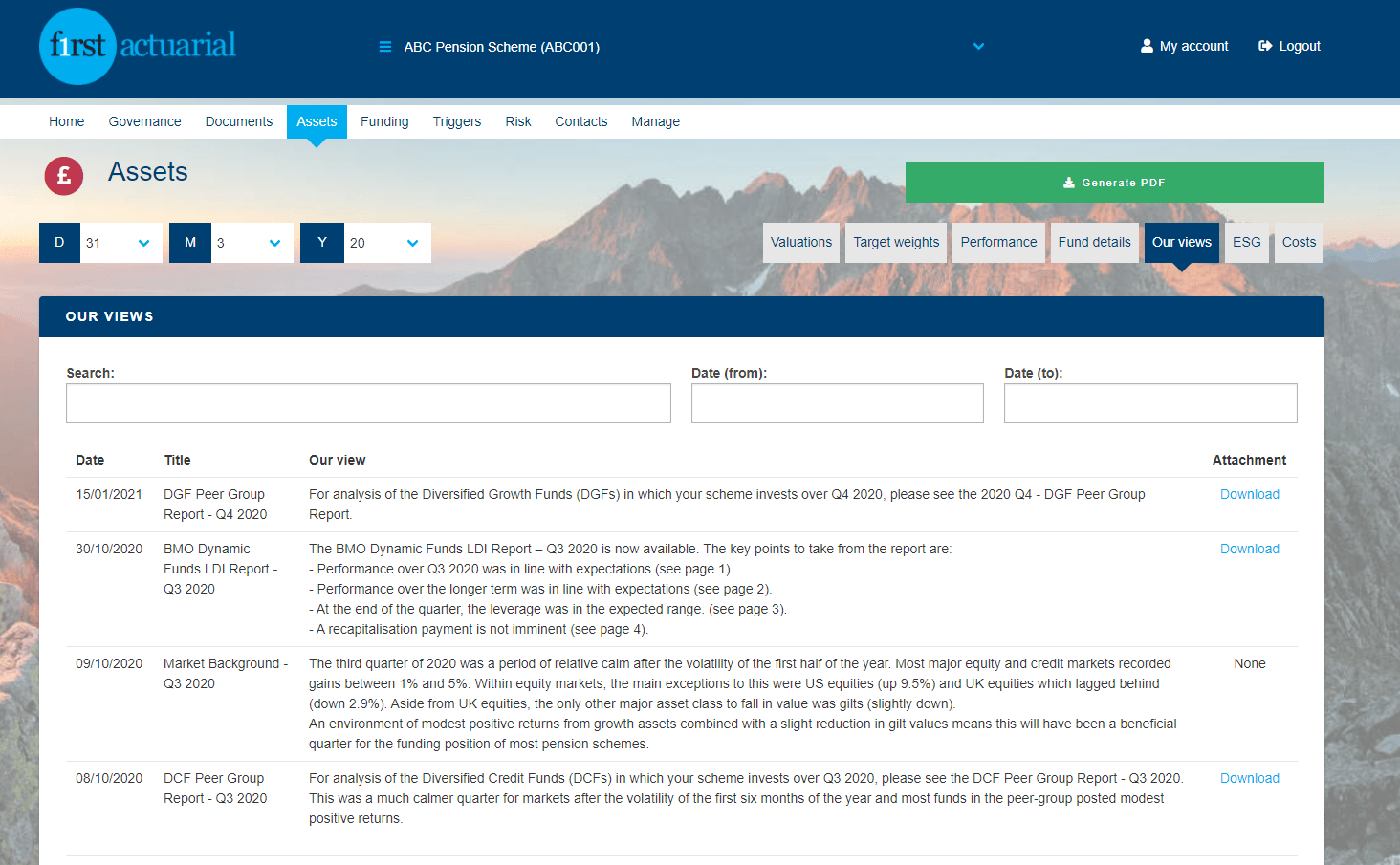

- Assessments of the ongoing suitability of funds held

- Concise updates on fund performance

- Performance monitoring documents, including peer-group reports and quarterly documents on Liability Driven Investment (LDI) funds.

We make this information easy to access, and we keep it up to date at all times. Where up-to-date information is available, we refresh asset valuations on a daily basis.